A trust is a legal setup where one person or a company (the trustee) holds and takes care of property or assets for someone else’s benefit (the beneficiary). Think of it like this: if you had a treasure chest full of gold and wanted to ensure it was taken care of after you went on a long journey, you might give it to a trusted friend with instructions on what to do with the gold. That friend is like the trustee, and the person or people you want to benefit from the gold are the beneficiaries. But how do trusts work?

The person who sets up the trust is called the grantor or settlor. When they set it up, they decide how the assets in the trust should be used – this could be anything from money to houses to stocks. The trust rules are written down in a document like a guidebook for how the trustee should use the assets. The trust can be set up to work while the grantor is still alive or after they pass away.

Using a trust means that the grantor can ensure their assets are used in specific ways and for specific reasons, like for their children’s education or charity. It’s a way to control the assets even when the grantor isn’t around. Plus, it can also help to keep those assets safe from taxes and legal problems that might come up.

Types of Trusts

There are many types of trusts, and each one works differently. Some trusts are set up to go into action immediately – these are called living trusts. They can help manage the assets while the grantor is still alive. Living trusts can be revocable, which means the grantor can change their mind and take back the assets or change the rules, or irrevocable, which means once it’s set up, it can’t be changed.

Then, some trusts are set up to start after the grantor dies. These are often included in a will and are called testamentary trusts. They help carry out the grantor’s wishes after they’re gone.

Some trusts are set up to help with taxes. By putting assets into a trust, sometimes those assets won’t be counted when it’s time to pay estate taxes, which can save a lot of money. Other trusts might be used to ensure that someone who can’t manage their own money, like a child or someone with special needs, is taken care of.

How Trusts Work

Trusts are a legal box where you can keep your assets safe and set rules about using them. When you set up a trust, you are ensuring that the things you own, like your house or savings, are managed the way you want, even if you are not around to take care of them yourself. You tell the trustee, the person or company you choose to look after the trust, exactly what they need to do. They might have to give money to your family every year, or they could use the money in the trust to pay for your kids’ school.

It works by taking the property out of your hands and putting it into the name of the trust itself. But it’s still yours because you set the rules for its use. This separation is why trusts are so good at protecting your stuff if something goes wrong, like if you have debts or there’s a legal issue, the assets in the trust are often safe because they’re not directly in your name anymore.

There are rules, of course. The trustee has to follow the instructions you put in the trust document, and they have to act in the best interest of the people who will benefit from the trust. They can’t use the trust to help themselves; it’s all about taking care of the assets for the beneficiaries.

Benefits of Trusts

One of the biggest benefits of a trust is privacy. Unlike a will, which becomes a public document when you die, a trust is private. Nobody needs to know what’s in it or who benefits from it unless you want them to. It’s a way of keeping your financial matters quiet and personal.

Trusts can also save you money on taxes. By putting your assets in a trust, you can pay less in taxes when you die because the trust might not be counted as part of your estate. This means more of what you have can go to the people or causes you care about.

Another benefit is that you can help people who might need help managing money. This could be a child who’s too young or someone with special needs. A trust makes sure they are taken care of the way you want.

Creating a Trust

Creating a trust can be simple or complex, depending on what you want it to do. The first step is to talk to a lawyer who knows about trusts. They can help you decide what kind of trust you need and what rules it should have. Then, you write those rules in a document, and that’s your trust agreement.

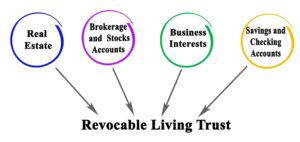

You’ll pick a trustee, a person you trust or a company that offers trustee services. Then, you move your assets into the trust. This could mean changing the titles of your property or accounts so that they’re owned by the trust instead of you.

After that, the trustee manages the assets according to your rules. If the trust is supposed to make money for your kids’ college, the trustee will ensure that money is invested wisely and spent only on education.