In the realm of estate planning, revocable living trusts have gained popularity as a versatile and effective tool. This comprehensive guide will provide you with an in-depth understanding of revocable living trusts, explaining what they are, how they function, and their advantages in managing your assets and securing your financial legacy.

Understanding Revocable Living Trusts

At the heart of estate planning, a revocable living trust is a legal entity designed to hold and manage your assets during your lifetime and distribute them seamlessly upon your passing. As the grantor, you have the flexibility to make changes, amend, or even revoke the trust during your lifetime, providing you with a high degree of control and adaptability over your estate.

At Nevada Trust Company, we are dedicated to assisting individuals like you in optimizing their estate planning strategies. Our expertise extends to various trust services, including Nevada Asset Protection Trusts and custody and escrow services. We understand the significance of revocable living trusts in shaping your financial future, and we are here to provide insights and guidance throughout the process.

The Key Elements of Revocable Living Trusts

- Grantor: The grantor, the individual who establishes the revocable living trust and transfers their assets into it, maintains full control and access to these assets during their lifetime.

- Trustee: The trustee, typically the grantor initially, is responsible for managing the trust and its assets. In the event of incapacity or passing, a successor trustee steps in to ensure that asset distribution adheres to the trust’s terms.

- Beneficiaries: Beneficiaries, whether individuals or entities are designated to receive the trust’s assets upon the grantor’s passing. Revocable living trusts offer flexibility in specifying beneficiaries and determining their respective shares.

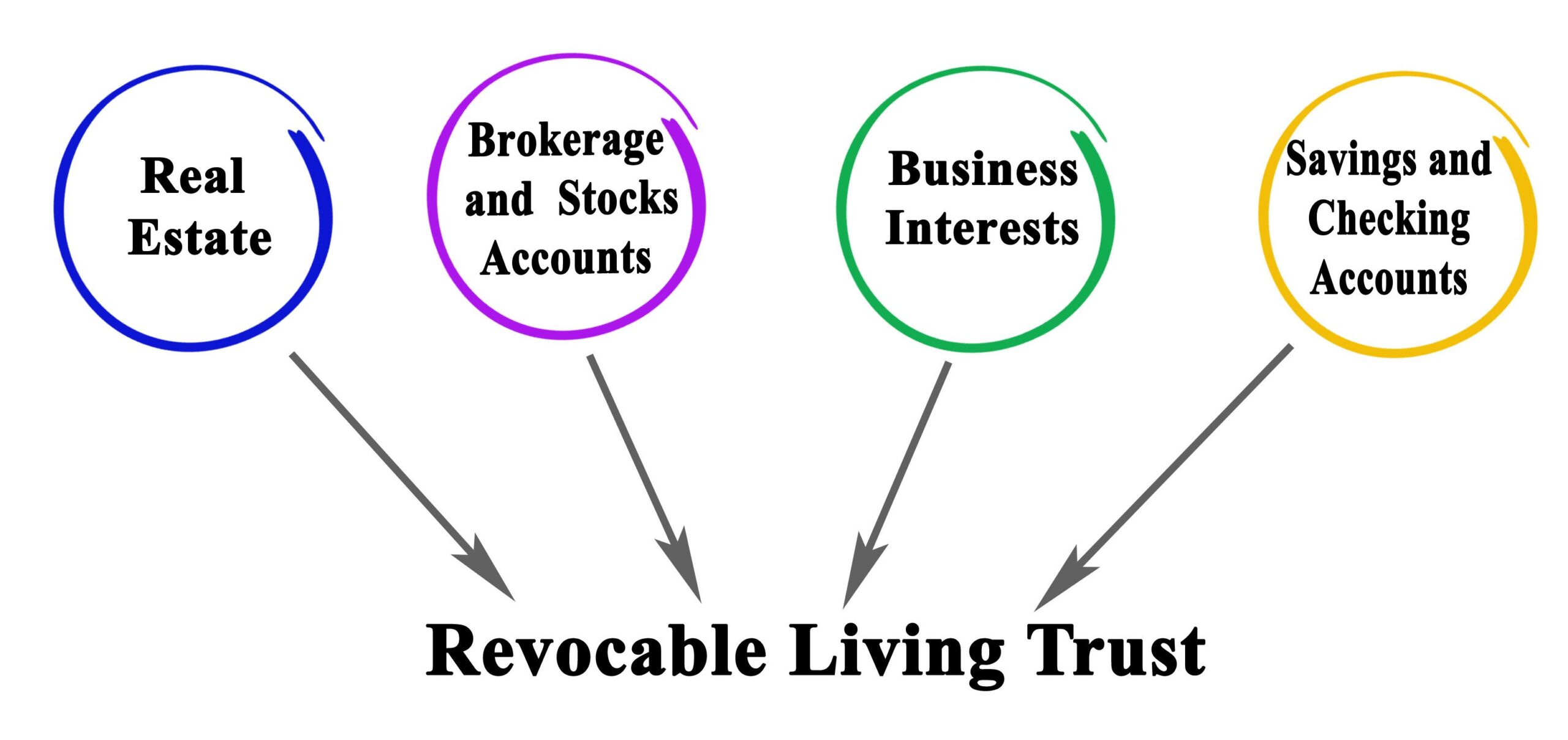

- Assets: Revocable living trusts can encompass a broad array of assets, including real estate, financial accounts, investments, and personal property. The grantor can transfer these assets into the trust, centralizing their management for added convenience and efficiency.

Top of Form

How Revocable Living Trusts Work

The functionality of a revocable living trust is both straightforward and adaptable:

Establishing the Trust

To initiate a revocable living trust, the grantor creates the trust document, outlining its terms and conditions. This document identifies the trust’s beneficiaries, the trustee(s), and the assets included. Upon signing, the trust becomes operational.

Asset Transfer

The grantor transfers ownership of their assets into the trust’s name, effectively repositioning them within the trust’s control. The grantor maintains full control and access to these assets during their lifetime.

Lifetime Management

As the trustee during their lifetime, the grantor retains management control over the assets held within the trust. They can buy, sell, or modify trust assets as needed, mirroring their existing financial management practices.

Incapacity or Passing

If the grantor becomes incapacitated or passes away, a successor trustee takes over the trust’s administration. This transition guarantees the smooth handling and distribution of assets by the trust’s predetermined provisions, eliminating the necessity for probate.

Probate Avoidance

One of the notable advantages of revocable living trusts is their ability to bypass the probate process. Since the trust owns the assets, they are not subject to the probate court’s jurisdiction, resulting in quicker and more private asset distribution to beneficiaries.

Advantages of Revocable Living Trusts

Probate Avoidance

The avoidance of probate is a primary benefit of revocable living trusts. By sidestepping the probate process, the distribution of assets to beneficiaries becomes expedited and private, reducing potential delays and costs.

Incapacity Planning

Revocable living trusts include provisions for the management of assets in the event of the grantor’s incapacity. This ensures that someone trusted can step in to handle financial affairs without the need for court-appointed guardianship.

Privacy

Since trust documents are not part of the public record, the details of the trust and its asset distribution remain private, shielding your financial affairs from public scrutiny.

Control and Flexibility

Grantors maintain control over their assets during their lifetime and have the flexibility to modify the trust as circumstances change. This adaptability is particularly beneficial for individuals with evolving estate planning needs.

Considerations and Limitations

Initial Setup Costs

Creating a revocable living trust typically involves legal and administrative fees for drafting the trust document. However, these costs are often outweighed by the benefits in terms of probate avoidance and streamlined asset distribution.

Funding the Trust

To realize the full benefits of a revocable living trust, it is imperative to transfer assets into the trust’s name. This may involve some logistical effort but is crucial for trust effectiveness.

No Estate Tax Reduction

Unlike some irrevocable trusts, revocable living trusts do not provide estate tax reduction benefits. They are primarily designed for probate avoidance and incapacity planning.

A revocable living trust is a versatile and effective estate planning tool that provides control, privacy, and probate avoidance. Nevada Trust Company is an expert in trust services, assisting you in exploring the advantages of revocable living trusts and their role in securing your financial legacy. By leveraging the flexibility of these trusts, you can tailor your estate plan to align with your unique goals and preferences, ensuring a smooth and confidential distribution of assets to your chosen beneficiaries.

Contact us today to secure your financial future!